Hi all, hope you’ve had a good week. Markets feel a bit calmer now, no?

Anyway, I’m happy to say I added a new company to the fund:

Aker BP. (AKRBP)

Big Norwegian oil.

Why them, and why now?

In one sentence: the more oil falls, the more value I see in oil companies.

But of course there’s more to it.

Here’s the TL;DR summary:

seen undervalued by at least 50%

impressive historical quality

high earnings yield

double-digit dividend

strong owners

short-term oil correlation doesn’t reflect long-term prospects

complements my Equinor holding nicely

That’s the quick summary. Read on to get into the specifics.

Let’s start with how I found them.

My magic formula screening star

I guess “found them” isn’t the right way to put it.

It’s Norway’s second-biggest oil company, so of course I know them.

But a screener I ran recently made them stand out.

It’s one of my favorite screeners. Very simple.

Just three criteria, inspired by Joel Greenblatt’s magic formula. Let’s call it my own magic formula right now.

Sidenote - if you haven’t read his “Little Book that Beats the Market,” you should. I’d say required reading for all stock-pickers out there.

Back to that simple screener. Here it is:

1. five-year ROCE over 20%

to find the “good” companies with lasting quality. We all want that moat. You can substitute ROCE for ROIC or ROA. Or use all three. I haven’t figured out which is best. But the concept is the same. Filter to find those companies with consistent high returns on capital.

2. debt/equity under 1.0

filters away companies with high debt. I’m not a fan of debt. For me or my stocks.

3. earnings yield

the inverse of PE. A great measure of value or being cheap. A high yield helps you feel you’re buying low.

Run this screener through Finchat and rank earnings yield from high to low.

You’ll see Aker BP comes in very high up there.

For any industry. Globally.

I’m in the Nordics. It’s an area I try to know well.

When I see Nordic companies coming in high on global screenings, I take extra notice.

Mixed feelings on Equinor

In that screener above, you’ll also see Equinor (EQNR). Right after Aker BP.

Like Aker, Equinor is big Norway oil. And it’s a company I’ve already invested in.

I’m happy to see Equinor so high on that list.

But a couple weeks ago I realized I have mixed feelings about Equinor.

Because: ownership. It’s state-owned.

I see this as both good and bad.

It’s good because it’s Norway. You can trust these sound, stable, democratic, uncorrupt governments up here in the Nordics.

It’s also good because state-ownership can bring security and long-term thinking.

That said, I typically don’t want state-owned enterprises.

You don’t really want politicians running companies. Political interests don’t always align with shareholder interests.

So when I saw Aker BP coming up so high in my screenings along with Equinor, I started to take a closer look.

You complement me

A couple of things I find interesting about Aker BP in relation to Equinor.

Ownership

First off, the ownership. Aker BP is private and has three key owners:

BP, which isn’t state-owned anymore

Nemesia S.A.R.L., which has roots in the Lundin mining concern

and Aker ASA, a big Norwegian industrial conglomerate run by one of Norway’s most successful businessmen

These are big, powerful long-term owners with long, strong track records. I’m sure they have their issues. But focusing on long-term value for shareholders probably isn’t one of them.

I also saw they have a very promising focus on dividend growth.

All-in-all, Aker BP’s ownership looks fine. Stable and promising.

Check.

Financials

And then, taking a closer look at the figures, I see Aker BP with:

3-year ROCE at 30% vs 38% for Equinor. Awesome.

10-year ROCE at 20% vs 22% for Equinor. Historically strong. Awesome.

a 93% gross margin vs 40% for Equinor. Wow.

0.6 debt/equity ratio for both. Cool - did I mention I don’t like debt?

10-year revenue CAGR of 40% vs 0.6% for Equinor. 40%? Inspiring.

12% dividend yield vs 11% for Equinor. Yes please.

Overall, this tells me Aker BP is as high-quality as Equinor.

With higher margins and growth.

Check.

The business

Then I of course looked closely into the business.

For operations, you can say Aker BP as a nimbler, more focused player. It’s primarily into the Norwegian continental shelf and upstream exploration & production.

Meanwhile, Equinor is bigger, more global, with a broader mix. Up-, mid- and downstream, with refineries and big into the energy transition.

Conclusion: I think they complement each other nicely.

Undervalued?

Ok, so you have this company you like. But how do you know you’re getting it at a good price?

Here’s how I figure it:

earnings yield of 13%. That’s robust, both vs industry and the overall market.

PE around 7. Low vs industry and market.

share price down about 11% the past month and 20% the past year. Great. They’re very unpopular now. Which makes me all the more interested.

more than 50% below intrinsic value, according to investment sites like Uncle Stock, Alpha Spreads and Valueinvesting.io.

I don’t give too much weight to DCFs. Nor to any one investment site.

But put all this together, and I’m fairly confident I’m not overpaying.

Oil

The final question I think you have to ask yourself is why. If they’re so solid and high-quality, why are they so cheap?

The answer - and it’s just a guess - is oil.

Oil’s cheaper, so oil companies are too. I think it’s pretty simple.

And it’s also odd.

Because short-term oil prices don’t reflect long-term fundamentals for big companies.

In the short-term, stock prices for oil companies often move in tandem with daily oil prices.

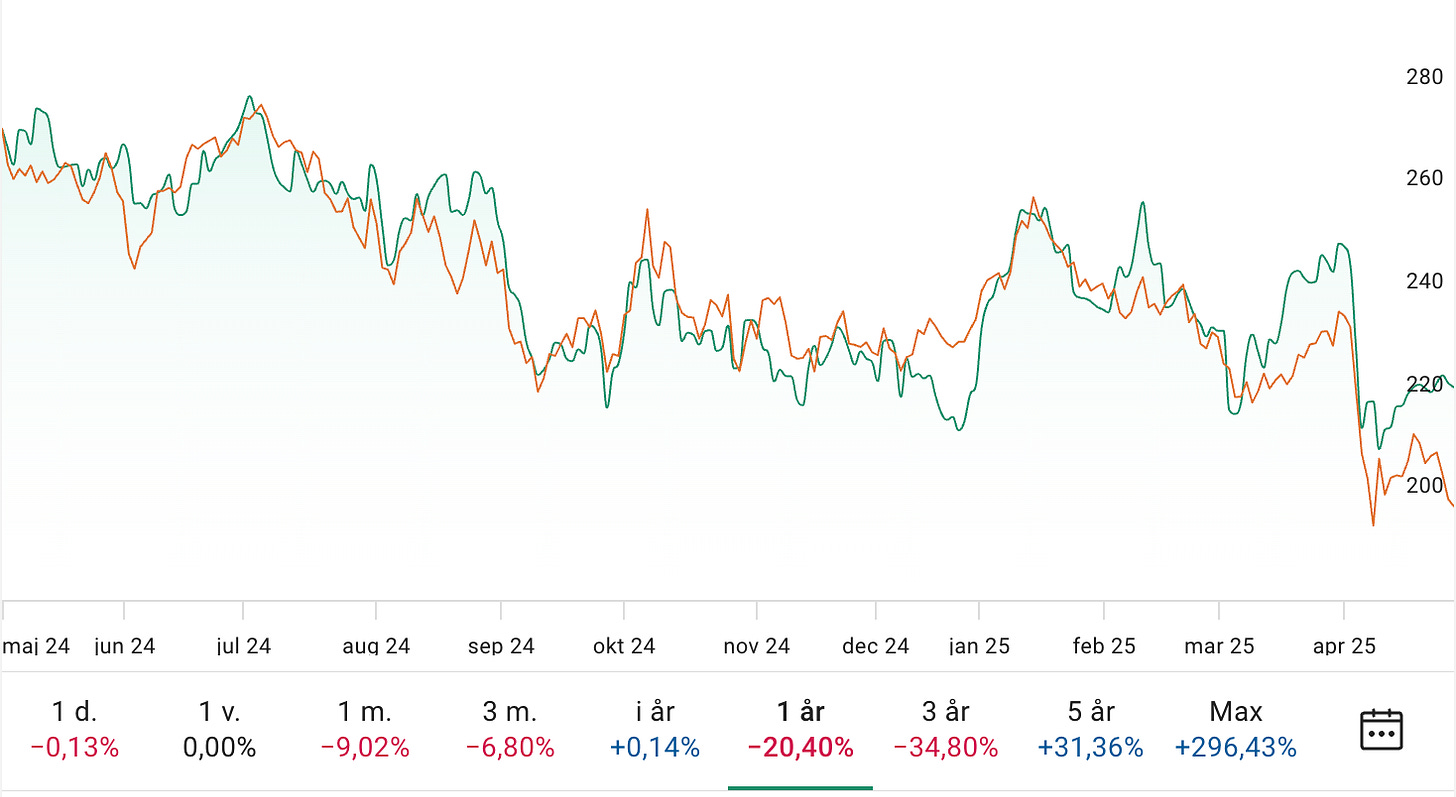

Like this chart, with Aker BP’s share price (in orange) and spot crude over the past year. You see short-term prices moving pretty much in tandem:

But then take a look at this chart, which is over a much longer horizon.

Aker BP and spot crude since 2008. Plus a third line showing reinvested Aker BP dividends. Ie big-time separation:

The point: maybe falling oil prices is why some high-quality oil companies like Equinor and Aker BP are so cheap right now.

Maybe. I don’t actually know. And I don’t really care.

What I care about is buying high-quality companies at low prices.

Along with Equinor, Aker BP looks like another stable, high-quality, low-debt company at a great price.

A good long-term bet despite falling oil prices. Or because of them?

So this week - I bought. At around 222 NOK per share.

And oh by the way, I’ve heard sometimes oil prices go up.

Thanks for reading. Talk to you next week.

Joel Sherwood invests each week and writes about what he buys, learns and earns. He’s a former financial journalist for Dow Jones and The Wall Street Journal, and a current bank employee. He lives in Stockholm, Sweden and started the Sherwood Investment Letter in January 2025. Purchases are not recommendations. Subscribe.

Nice write up. I am not as familiar with Aker, but I believe I read they recently made a nice discovery. Equinor may also have an advantage due to LNG.

Thank you very much for your post!

I was not able to find out why Norwegian can produce sooo cheap oil, there is no logic factor behind it and what disturbs me about AKER BP is the last dividend cut, this is no good sign

All in all, I think it's a good company

But those 2 facts bother me